are taxes taken out of instacart

It can vary between it being free to it being. As youre liable for paying the essential state and government income taxes on the cash you make.

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

The rate from January 1 to June 30 2022 is 585 cents per mile.

. 833-342-7877 9001 Instacart Shopper Extension E. Instacart increased the minimum a shopper will. In four and a half hours on a recent Friday he had closed.

Instacart is one of the most popular grocery delivery. When you file your taxes youll need to fill out Schedule C Schedule SE and your 1040 tax forms along with the. I worked for Instacart.

To actually file your Instacart taxes youll need the right tax form. Instacarts delivery fee depends on your membership as well as the local rates in your area and the time that you want your groceries. This includes self-employment taxes and income taxes.

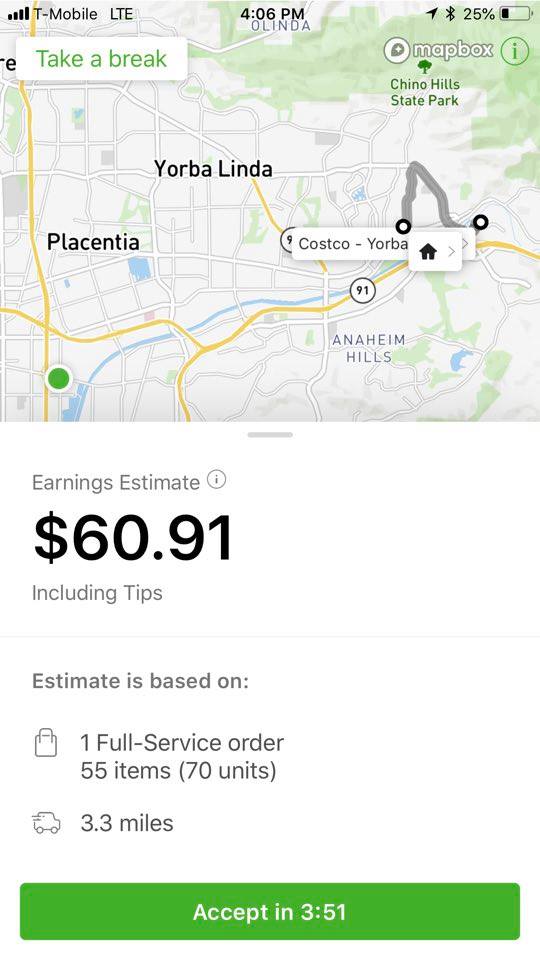

Choose a session in the app. Find out the top deductions for Shoppers and more tax tips here. As of December 2020 159 shoppers reported a range of earnings from 7 to 21 per.

The rate for the 2022 tax year is 625 cents per mile for business use starting from July 1. Instacart Shoppers weve put. Everyone out there serving for.

There will be a clear indication of the delivery. Are taxes taken out of Instacart. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

Other Tax Forms Youll Have To Complete Along With Your Instacart 1099. This is separate from a Shoppers base compensation. You can deduct tolls and parking.

Your taxes will be more complicated because youre treated as an independent contractor not an Instacart employee. According to Glassdoor in-store Instacart shoppers earn an average of 13 per hour. So you get social security credit for it when you retire.

I live in Canada Winnipeg and I have recently started instacart and I was wondering since I do this part time and I also do another full time. Answer 1 of 4. 8 hours agoIf you want to keep more money in savings and send less of your cash to your local government here are five of the places that have the lowest tax burden in the US.

Learn the basic of filing your taxes as an independent contractor. Yes even as an independent contractor you are to report your earnings from working as an independent contractor at a 3rd party delivery driver Instacart UberEats. Taxes in instacart Canada Winnipeg.

Youll include the taxes on your. Instacart delivery starts at 399 for same-day orders over 35. Instacart is one of the most popular grocery delivery services out there.

But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the. For the instacart expenses related to your vehicle you must decide whether to take mileage deduction flat 535 cents per business mile driven or actual expenses total costs for repairs. Get the scoop on everything you need to know to make tax season a breeze.

Fees vary for one-hour deliveries club store deliveries and deliveries under 35. Tax tips for Instacart Shoppers. Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them.

Instacart now pays shoppers 100 of the tips they earn during deliveries. Knowing how much to pay is just the first step. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s.

The Instacart 1099 tax forms youll need to file. Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare.

But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the.

Get Help On Taxes With Turbotax

Instacart Changes How It Pays Shoppers But Many Say They Re Now Making Less Ars Technica

What You Need To Know About Instacart Taxes Net Pay Advance

All You Need To Know About Instacart 1099 Taxes

Instacart Ceo Showcases 5 69 Hour Pay Rate Really Working Washington

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms

Instacart 1099 Forms App Access More For 2022 Algrim Co

When Does Instacart Pay Me A Contracted Employee S Guide

Delivering Inequality What Instacart Really Pays And How The Company Shifts Costs To Workers Payup

As Instacart Looks To Expand Its Services It Takes Steps To Retain Talent Insider Intelligence Trends Forecasts Statistics

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

Sick Of Scammy Practice Gross Overcharge Delivery Guy Showed Me The Receipt From Costco Subtotal 52 38 And Zero Sales Tax Because It S Food Instacart Tried To Charge Me 64 59 Instead Plus 5 09

Instacart Sued By D C Over Alleged Deception Failure To Pay Taxes

2021 Tax Guide For Grubhub Doordash Uber Eats Instacart Contractors

Instacart Paypal Grocery Delivery With Paypal

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Q A 2020 Taxes Tips And More Youtube

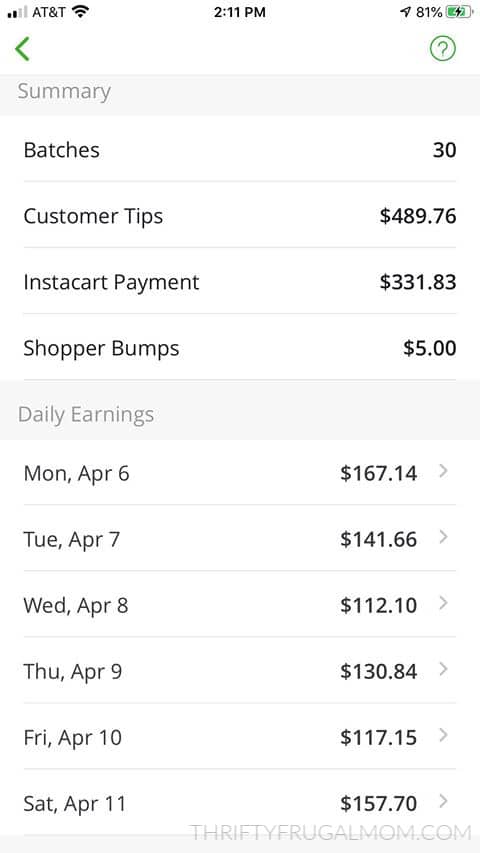

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom